The Challenge

Washington State Employees Credit Union (WSECU) is a not-for-profit credit union known for providing unparalleled service to its 300,000+ members. This includes consistently quickly delivering high-quality credit and debit cards to members.

In 2023, WSECU embarked on a corporate rebrand, including introducing new card designs to its members.

However, they faced significant challenges with their existing card production and personalization partner. The partner’s restrictive guidelines and limitations on card artwork prevented WSECU from fully realizing its brand vision. Moreover, any newly approved artwork resulted in considerable delays, with many orders completely stalled during programming. As a result, cards arrived at contact centers and branches up to two weeks late, which degraded the member experience and posed a threat to WSECU’s brand. Additionally, WSECU wanted to leverage the benefits of print-on-demand production, but the card production partner operated on an inventory-based system. This legacy model, which relies on maintaining an inventory of card stock, not only increased upfront costs but also created work for WSECU due to the ongoing hassle and expense of inventory management.

As challenges mounted, WSECU sought a new card production partner with a true print-on-demand model capable of executing multiple designs without production delays. To find the ideal partner, WSECU leveraged its membership with MAP, a trusted card-processing services partner for credit unions, to point them in the right direction.

The Solution

WSECU turned to Arroweye to manage its EMV card program, which enabled WSECU to finally showcase the new brand through its card designs. This was quickly followed by transitioning WSECU’s contactless and dual interface card programs to Arroweye.

The Results

Partnering with Arroweye was transformative for WSECU. The credit union successfully transitioned both its EMV and dual-interface card programs, achieving all goals related to card design and art quality, production timelines, and leveraging the many benefits of a true print-on-demand, zero inventory model.

WSECU brought its brand to life through its card designs with Arroweye. They currently run eight different card designs, with the flexibility to add additional creative designs in the future. Additionally, the quality of both the artwork and carriers exceeded WSECU’s expectations.

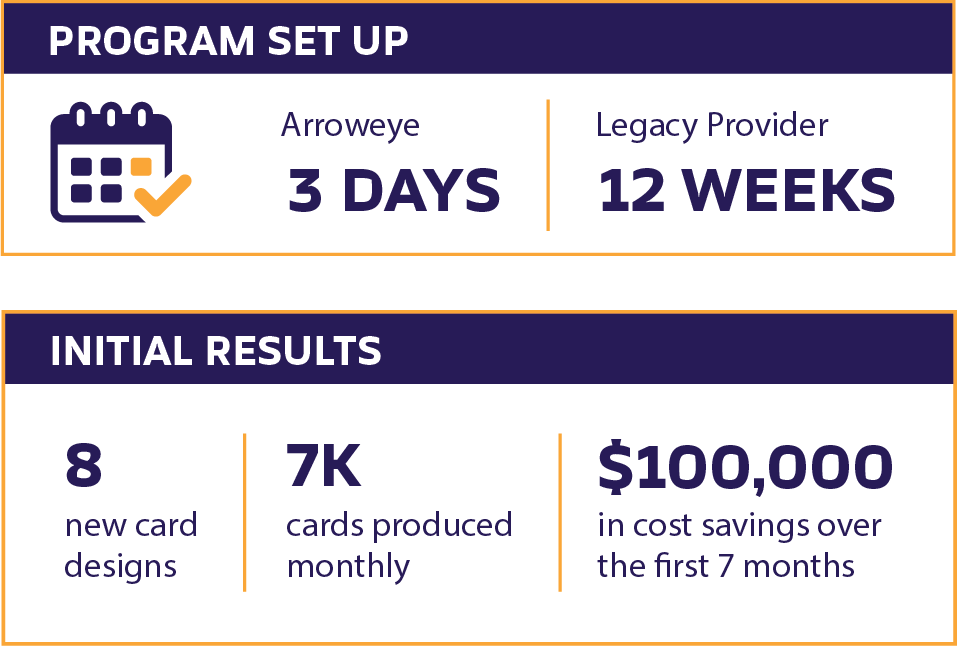

From a production and timing perspective, both card programs were executed flawlessly, thanks to Arroweye’s zero-inventory, just-in-time production model. Once WSECU finalized the art, Arroweye returned the proofs in under three business days and moved on to testing. This was a significant improvement compared to the previous provider, which took around 12 weeks to produce and ship the plastic. Not only did this new production model improve efficiencies, but it also resulted in significant cost savings. Within the first seven months of switching to Arroweye, WSECU saved an average of 24% each month for a total of over $100K.

Another benefit of Arroweye’s just-in-time production model is that it eliminated the hassle of inventory management and all associated costs for WSECU. Now, WSECU pays only for the cards it needs when it needs them. They can also adapt easily to changes in card demand, as production does not stop for changes big or small. And when changes are needed, Arroweye handles them in just a matter of days.

About Arroweye

Arroweye Solutions is the only provider of dynamic, just-in-time payment card production and fulfillment services. Using patented technology, Arroweye offers a fully customizable and scalable solution that eliminates the need for pre-printed card inventory, enabling financial institutions, fintechs, prepaid programs and others to respond quickly to market demands and customer needs.

About WSECU

WSECU is a not-for-profit credit union open to all Washington residents with a special emphasis on serving those who embrace the values of giving, sharing and supporting their communities. WSECU was founded by a small group of Washington state employees in 1957 and now has 315,000 members, 24 branches, $5 billion in assets and was recognized as number one in Washington state on the Forbes Best-In-State Credit Unions 2023 list. It commits 4 percent of its annual net income to invest back into the communities it serves through partnerships with education and other nonprofit institutions.