New hires support company’s investment in enhanced technology, products, and services to power partners’ growth

Arroweye Solutions, the only provider of just-in-time payment cards, has added three industry veterans to its leadership team. The new hires are part of a larger Arroweye initiative to strategically invest in resources and technology that advance its bank, credit union, and fintech partners into the next era of digital payment card technologies and services.

The market for all types of credit, debit, and payment cards is on the rise as financial service providers meet existing needs and drive demand for new use cases – from earned wage access and payroll to digital and mobile payment accounts.

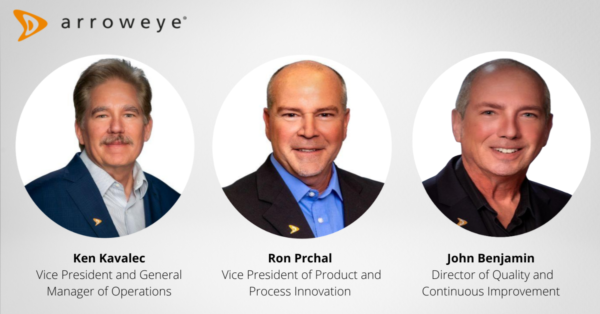

Each of these leaders has decades of experience advancing card production strategies and execution to enhance operations:

Ken Kavalec, Vice President and General Manager of Operations

For nearly three decades, Ken led national operations for one of the largest North American third-party credit card personalization providers. His deep background in this space will help Arroweye drive efficiencies, continually improve its product and service offerings, maximize its resources, and optimize client ROI.

Ron Prchal, Vice President of Product and Process Innovation

Leveraging more than three decades of experience pioneering advancements in the payments industry, Ron leads the research and implementation processes that will help Arroweye offer ever-evolving, innovative products and services. His deep expertise and knowledge base will help drive business strategy and capabilities growth.

John Benjamin, Director of Quality and Continuous Improvement

John is a well-known payment card industry veteran with four decades of experience. He is well-versed in digital print, fulfillment, serialized packaging, and payment card production techniques and strategies. He is also a recognized expert in product development and innovation, technical account management and operational management.

“The market for all types of credit, debit, and payment cards is on the rise as financial service providers meet existing needs and drive demand for new use cases – from earned wage access and payroll to digital and mobile payment accounts,” said Dan Oswald, Chief Executive Officer at Arroweye. “We are pleased that these three industry leaders have joined the Arroweye team to help accelerate our innovation and bolster our day-to-day delivery for our clients’ card solutions.”

As many financial institutions and fintechs continue to modernize and expand their product portfolios, they are looking to offer more digital-friendly, next-generation payment options to a wide range of end users.

Arroweye’s technology-driven platform delivers low-risk, customized card campaigns through a zero inventory, no-waste card production and fulfillment model that supports the banking and fintech community on demand. Using dynamic card production methods and leaning on its technology resources, Arroweye can onboard new programs in days and scale orders as needed via its just-in-time production capabilities.